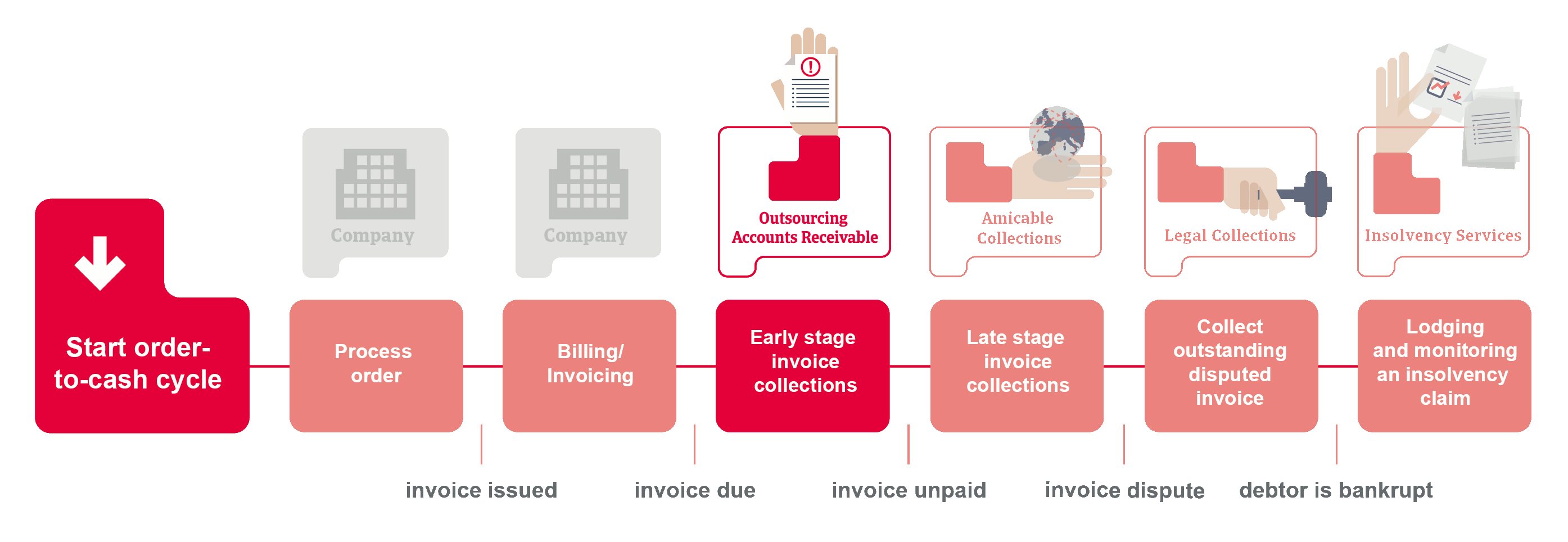

Receiving payments on time can be challenging. Our outsourcing accounts receivable solution offers support where, when and how you need it.

Outsource Your Business’ Accounts Receivable

With a robust accounts receivable management process, the majority of outstanding invoices will not turn into business debts. However, it can be a challenge for businesses to stay on top of accounts receivable; for example, receivables in regions where you don’t have staff who speak the language. That is why we create a custom-made solution based on your business's needs in order to put you back in control.

With our support, your business can:

Reduce DSO and lower the ageing bracket

Businesses run more smoothly when cash flow is in order. We make incremental changes to reduce your DSO and ensure fast billing cycles so that your business remains liquid.

Overcome language barriers in smaller markets

Finding and retaining people with the knowledge and language capabilities that you need can be difficult. We have well-trained Accounts Receivable Managers in every corner of the world that speak the local language and know the local culture.

Ensure continuity and flexibility in credit control activities

We chase outstanding invoices earlier to prevent problems with bad debts later – that means your overdue accounts receivable decreases. The combination of our credit management software and trained staff ensure that customers pay on time, every time.

Our Services

We tailor our First Party solutions to your needs.

We can include some or all of the following services in our tailored offering, in line with your needs and in the language of your customers.

Reminder calls

Contacting your customers shortly after due date.

Dunning letters

Staying on top of your dunning cycle through dunning letters.

Inbound service

Answering inbound calls concerning your accounts receivable in the language you require.

Dispute registration

Logging, assigning and reporting reasons for non-payments.

We also offer:

- Pre-calling

- Payment plan monitoring

- Outbound reminder calls

- Collect letter service

- Portfolio overview

- Risk prevention

If an invoice remains unpaid despite all these efforts, our professional Debt Collection team is well-placed to escalate the collection processes from initial Amicable Collection activities to Legal Collection if necessary.

Let’s find a solution

In order to ensure you receive a solution that fits your needs, we analyse different aspects of your accounts receivable management process. These include:

- Processes: to determine which processes fit best to your accounts receivable portfolio

- System: to determine the best way to set up the system to service your portfolio

- Portfolio: to determine what your portfolio looks like

- People: to figure out what kind of accounts receivable experts can best service your portfolio.

Contact us now

We are there for your business as a total bespoke accounts receivable partner.

Please get in contact with us today to discuss your needs with one of our experts.