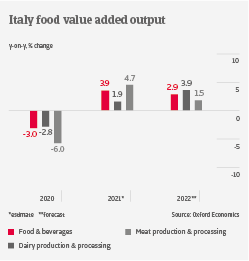

After a 3% contraction in 2020, Italian food & beverages value added output rebounded 4% in 2021, and is set to grow further in 2022, supported by domestic consumption and recovering exports. Food retailers benefitted from growing revenues during the lockdowns, with sales now back again to normal levels. The dairy segment recorded increasing domestic and export sales last year, while the beverages subsector remains affected by lower demand from hospitality.

High prices for cereals, milk, oil and sugar are impacting processors and producers across most key subsectors, such as meat, dairy, pastries/pasta. Increased energy prices affect segments like food mills, pasta producers and businesses with food preservation. Energy costs are also an issue for retailers with large selling surfaces.

Due to the market power of large retailers, food producers and processors have troubles to pass on higher input prices, which results in lower profit margins. However, we do not expect a serious deterioration of margins. That said, food service businesses and wholesalers depending on the hospitality sector remain under pressure, after suffering from a sharp decrease in sales and margins during the lockdowns. Revenues have recovered somewhat in 2021, but not reached pre-pandemic levels yet. The short-term outlook remains uncertain, as the ongoing spread of the pandemic prevents a strong rebound of hospitality.

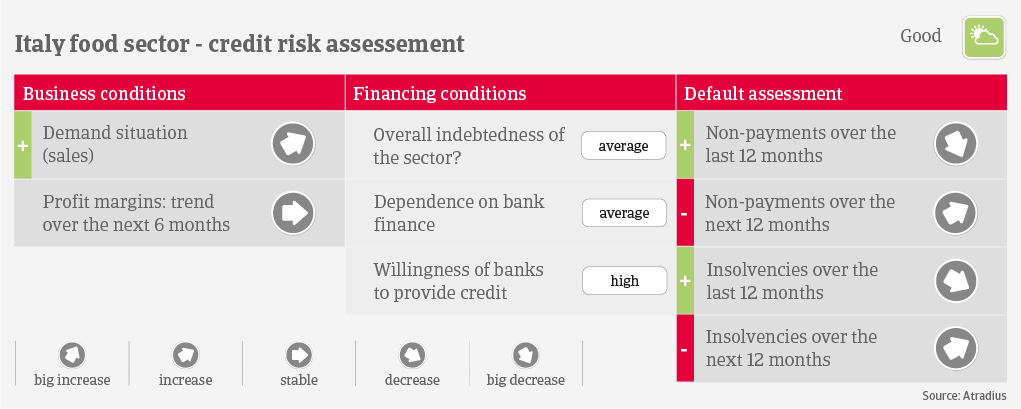

While dependence on bank financing is rather low in the food retail segment, it is higher in the food producing/processing subsectors. Due to the non-cyclical nature of food & beverages, banks are generally willing to provide loans to the industry. Payments in the sector take 60 days on average, and payment behaviour has been good over the past two years. Both payment delays and insolvencies have decreased over the past couple of months, down to a very low level. This is mainly due to additional liquidity provided by stimulus measures (e.g. bank loans with state guarantee).

With the gradual expiry of government support, we expect that payment delays and insolvencies will increase year-on-year in 2022, back to normal levels. Our underwriting stance is open for most subsectors, with a more cautious approach in the food services and wholesalers segments.