How to Conduct an Accounts Receivable Risk Assessment

In our risk assessment guide, we show you in 7 easy steps how you can manage your account receivables. For example, calculating your DSO or considering your debtors' creditworthiness can help in projecting a clearer picture. By identifying which default risks arise from the overall structure of your company's accounts receivable could lead to improvement and success, positively impacting your company's cash flow.

Effective management of collecting accounts receivable is crucial in identifying and mitigating risks related to extending credit to customers. There's always a chance that some customers will default on payments, regardless of risk management efforts. This underscores the importance of having robust strategies in place to minimize such risks and protect the company's financial health.

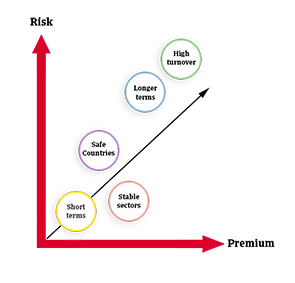

1. Receivables structure - Analyze the receivables structure and establish a risk profile according to customer groups, size, and spread.

2. Potential exposures - Pay attention to potential exposures by evaluating debtor security arrangements and potential insolvency repercussions.

3. Past bad debts - Evaluate past bad debts to identify inefficiencies in your accounts receivables management and determine default risks.

4. Days of Sales Outstanding (DSO) - Calculate the days of sales outstanding (DSO) to further assess the efficiency of your receivables management. Days Sales Outstanding (DSO) measures the average number of days a company takes to collect payment for a sale.

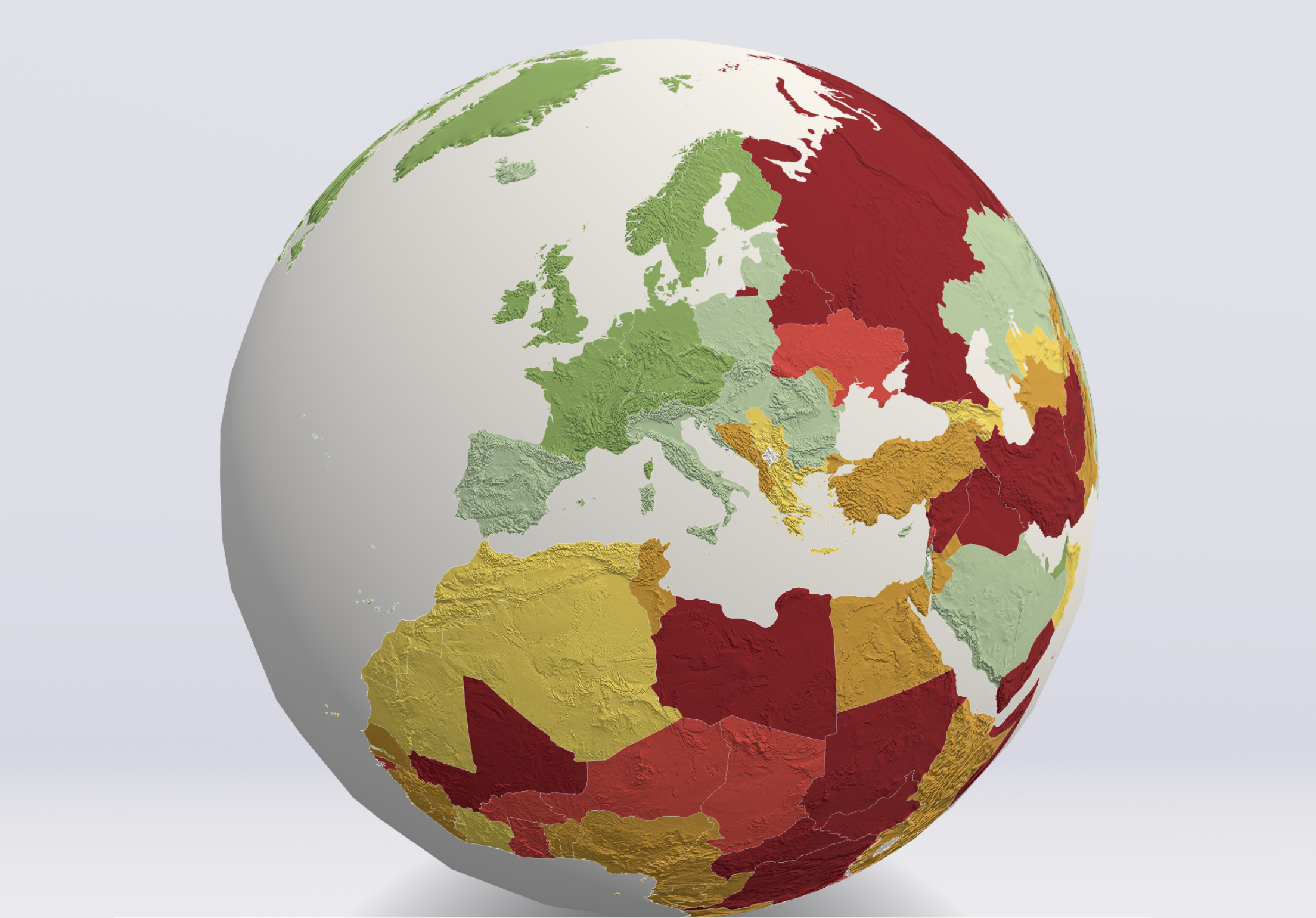

5. Future risks - Consider future developments when assessing your debtor's creditworthiness.

6. Terms of payment - Establish or adjust payment terms to meet your company's requirements.

7. Credit manager qualifications and skills - Ensure the presence of qualified credit managers and employees for more successful management of receivables.

Understanding Accounts Receivable Risk Management

Accounts receivable risk management is a critical component of a company's overall risk management strategy. It involves identifying, assessing, and managing the risks associated with accounts receivable and extending credit to customers. Effective accounts receivable risk management helps reduce instances of unpaid invoices and minimizes the impact on cash flow. By understanding the risks associated with accounts receivable, businesses can take proactive steps to mitigate them and improve their overall financial health. This proactive approach not only safeguards the company's cash flow but also enhances its ability to make informed financial decisions, ensuring long-term stability and growth.

Identifying Accounts Receivable Risks

There are several types of accounts receivable risks that businesses should be aware of. These include:

- Credit risk: The risk that a customer will not pay their invoice on time or at all.

- Payment risk: The risk that a customer will not make a payment on time.

- Collection risk: The risk that a business will not be able to collect payment from a customer.

- Liquidity risk: The risk that a business will not have sufficient cash flow to meet its financial obligations.

- Operational risk: The risk that a business's internal processes and systems will not be able to manage accounts receivable effectively.

By identifying these risks, businesses can take steps to mitigate them and improve their accounts receivable management. For instance, understanding credit risk can help in setting appropriate credit limits, while recognizing operational risks can lead to process improvements that enhance efficiency and reduce errors. Grouping customers by payment trends can help identify high-risk profiles, allowing businesses to focus their efforts on mitigating potential issues.

Assessing Customer Creditworthiness

Assessing customer creditworthiness is a critical step in accounts receivable risk management. This involves evaluating a customer's financial history, credit score, and other relevant factors to determine their ability to pay their invoices on time. Before choosing to work with a customer, it is essential to review their credit history. By assessing customer creditworthiness, businesses can determine the level of credit risk associated with extending credit to a particular customer and make informed decisions about whether to extend credit and what payment terms to offer. This assessment helps in setting appropriate credit limits and payment terms, ensuring that the company's cash flow remains stable and reducing the likelihood of encountering unpaid invoices.

Conducting a Receivables Risk Assessment

Conducting a receivables risk assessment involves evaluating the risks associated with accounts receivable and identifying areas for improvement. This includes:

- Reviewing payment history and credit reports.

- Analyzing industry and market trends.

- Evaluating customer creditworthiness.

- Assessing the effectiveness of internal processes and systems.

- Identifying areas for improvement and implementing changes to mitigate risks.

By conducting a receivables risk assessment, businesses can identify areas for improvement and take proactive steps to mitigate risks and improve their accounts receivable management. This comprehensive approach ensures that potential issues are addressed before they impact the company's cash flow, leading to more efficient and effective receivables management.

/Banners/with-ciq-.png/jcr:content/with%20ciq%20.png)

Implementing AR Automation and Technology

Implementing AR automation and technology can help businesses streamline their accounts receivable processes and improve their risk management. Accounts receivable automation provides real-time data analytics, enabling businesses to anticipate payment delays. This includes:

- Automating payment reminders and follow-ups.

- Implementing online payment options.

- Using accounts receivable software to track and manage invoices and payments.

- Implementing credit risk analysis tools to assess customer creditworthiness.

- Using data analytics to identify trends and areas for improvement.

By implementing AR automation and technology, businesses can improve their accounts receivable management, reduce the risk of unpaid invoices and overdue payments, and improve their overall financial health. Credit-IQ makes this process even easier by offering automated workflows, real-time tracking, and professional debt recovery services through Atradius Collections. With Credit-IQ, you can send automated reminders, track payments, and escalate overdue invoices effortlessly — all in one platform.

Try Credit-IQ for free and see how it can transform your AR process:

Click here to learn more about Credit-IQ.