Accounts Receivable Services & Outsourcing

Accounts Receivable Outsourcing

Demand letters

Credit-IQ

Benefits of outsourcing

Tailor-made to reduce overdue AR

15,000 businesses worldwide entrust their invoices to us every year. We support you in managing accounts receivables effectively. We create an AR strategy based on the number of invoices and location of your customers.

Our technology and intelligence optimize your cash flow by balancing between AR risk and customer retention.

Using our accounts receivable services enables you to focus on your core business activities and maintain your confidence in your credit process. We recognize that each company's needs are unique and understand that "One Size Does Not Fit All".

Therefore, we work with you to develop solutions specifically tailored to your requirements while balancing customer retention, cash flow, and dispute resolution. Stay in control while our locally-based AR experts work as part of your team and strategy to get your invoices paid on time.

What is Accounts Receivable Management?

Accounts receivable management is the process of monitoring and controlling the money customers owe to a business for goods or services purchased on credit. Accounts receivable management (AR) involves a comprehensive system of processes designed to track outstanding invoices, including billing, payment processing, client communications, internal processes, collections, and credit policies. Accounts receivable (AR) is significant for managing outstanding invoices and securing cash flow, representing money owed to a business for goods or services sold on credit, functioning as short-term assets on a company’s balance sheet. Effective accounts receivable management is crucial for maintaining a healthy cash flow, reducing the risk of bad debt, and fostering strong customer relationships. Timely and accurate billing builds trust and confidence in business-client relationships, further enhancing these relationships. By ensuring timely customer payments and minimizing overdue payments, businesses can improve their financial stability and focus on growth, which is essential for maintaining the company's financial health. Additionally, efficient accounts receivable processes can reduce the costs associated with debt collection, bad debts, and administrative overhead.

Definition of Accounts Receivable

Accounts receivable refers to the outstanding invoices a company has, representing money owed by customers for goods or services delivered. These outstanding invoices function as short-term assets on a company’s balance sheet, often appearing as IOUs from clients or customers. Effective management of accounts receivable is essential for maintaining a healthy cash flow, ensuring that a business has enough liquidity to meet its short-term obligations. By keeping a close eye on outstanding invoices, businesses can better manage their cash flow, reduce the risk of bad debts, and ensure financial stability.

Accounts Receivable Process

The accounts receivable process involves a structured sequence of actions to invoice clients, monitor payments, and secure the collection of funds owed. This process serves as a vital link between sales and revenue, ensuring that business transactions are successfully concluded through timely payments. The accounts receivable process cycle includes several key steps: customer order placement, credit approval, invoice dispatch, collections management, writing off uncollectible debts, payment processing, cash application, and dispute resolution. Involving multiple teams in the accounts receivable process increases efficiency and avoids redundancies, ensuring smoother operations. Each step is essential in managing accounts receivable effectively, ensuring that outstanding invoices are tracked and resolved promptly. However, many organizations still rely on manual invoicing, phone follow-ups, and archaic data systems, which can hinder the efficiency of these processes.

Overview of the AR Process

The accounts receivable (AR) process is a cornerstone of a company’s financial operations, playing a crucial role in maintaining a healthy cash flow. This process involves managing outstanding invoices, ensuring timely customer payments, and implementing effective credit policies. The AR process acts as a vital link between sales and revenue, ensuring that business transactions are successfully concluded through prompt payments. Effective AR management is essential for reducing the risk of bad debt and fostering strong customer relationships. By keeping a close eye on outstanding invoices and ensuring timely customer payments, businesses can maintain a healthy cash flow and focus on growth.

Challenges in Accounts Receivable Management

Managing accounts receivable can be challenging due to several factors. Poor communication between the AR team and customers can lead to misunderstandings and delayed payments. Traditional AR processes are often inefficient, relying on manual tasks that are time-consuming and prone to errors. Additionally, data can be difficult to find and evaluate in real-time, making it hard to make informed decisions. Siloed data can prevent AR teams from efficiently resolving payment disputes, further complicating the process. Effective dispute management practices strengthen customer relationships and enhance loyalty over time, helping to mitigate these challenges. These challenges can result in cash flow gaps, hinder a company’s ability to meet immediate financial obligations, and even lead to missed growth opportunities or bankruptcy. Effective accounts receivable management is critical to overcoming these challenges and ensuring a company's financial health.

Common Challenges in AR Management

Managing accounts receivable can be fraught with challenges, particularly for businesses with a large customer base or complex payment processes. Common issues include poor communication between the AR team and customers, which can lead to misunderstandings and delayed payments. Traditional AR processes often rely on manual tasks that are time-consuming and prone to errors, making them inherently inefficient. Additionally, data can be difficult to find and evaluate in real-time, complicating decision-making. Managing credit policies and extending credit to customers can also be challenging, as can ensuring efficient payment processing and cash application. Finally, resolving disputes and managing overdue payments can further complicate the AR management process.

Accounts Receivable Outsourcing

Flexible and scalable

Completely or partially outsourcing your accounts receivable management does not have to be as complex as it may seem.

We create an accounts receivable strategy that tackles your challenges most effectively. By calculating the average accounts receivable, we measure how efficiently your business collects debts, providing valuable insights for financial forecasting and identifying areas for improvement. Whether you need support with a high number of invoices or with customers in different countries, we can build a solution that gets results.

Demand Letters

Outsourcing Demand Letters for Greatest Effect

Our experienced Collections team applies the most effective letters for each jurisdiction, providing you with a quick and cost-effective method of obtaining payment from your debtors.

The dunning process, where a customer is notified when they become overdue in paying an invoice, can be an effective method in minimizing debt. The Collection Letters usually follow a progression from a polite reminder to a firm Final Demand and are governed by varying laws in each country.

Our customers tell us that our Collection Letters and Final Demand For Payment Letters are particularly useful for smaller debts that are difficult to chase due to the high numbers but low values. These debts can take up a significant amount of your time to collect, tying up large amounts of your resources. Collection Letters provide a simple and effective option for escalation with minimal cost. Automated reminders can prompt customers to pay on time, freeing up AR management teams to focus on more complex tasks.

Best Practices for Accounts Receivable Management

Implementing best practices for accounts receivable management can significantly improve cash flow and reduce the risk of bad debt. To effectively manage accounts receivable, businesses should implement strategies that maintain cash flow, minimize bad debts, and enhance customer relationships. Key practices include extending credit to customers judiciously, sending invoices promptly, and providing multiple payment options to facilitate timely payments. Defining clear billing procedures and ensuring transparent communication with customers are also essential. Clear billing procedures define expectations internally and externally, helping to streamline the process and reduce misunderstandings. Providing multiple payment options allows customers to remit with their choice method, giving them fewer excuses for failing to pay. Utilizing collections email templates can streamline the follow-up process, while automating accounts receivable management can reduce manual tasks and increase efficiency. By adopting these best practices, businesses can enhance their receivable management processes and maintain a healthy cash flow.

Effective AR Management Strategies

To navigate the complexities of AR management, businesses can implement several effective strategies. Automating AR processes can streamline operations, reduce errors, and improve efficiency. Clear credit policies and procedures help manage the risk associated with extending credit to customers. Providing multiple payment options can facilitate timely payments and enhance customer satisfaction. Defining clear billing procedures and payment terms ensures that both the business and its customers have a mutual understanding of expectations. Clear communication with customers and internal teams is essential for resolving issues promptly. Utilizing collections email templates can improve communication and streamline follow-up processes. By automating these tasks, businesses can reduce manual work and focus on more strategic activities.

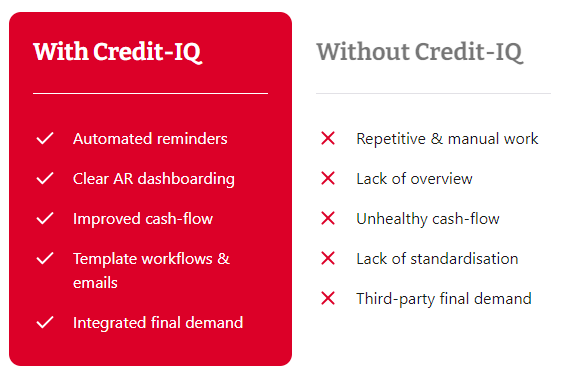

Credit-IQ:

Automate and accelerate accounts receivable

Credit-IQ, our new AR automation software, monitors overdues, sends automatic reminders, and prompts customers to pay faster. Benefit from pre-set workflows and reminders that are customizable to fit your brand, tone of voice, and customer language.

Click here to start your free trial!

Automate Accounts Receivable

Automating accounts receivable management can refine business operations, simplify and fortify invoicing and collections processes, and provide valuable insights into sales trends, customer buying habits, and market conditions. Automation ensures that all transactions are recorded accurately and in real-time, improving cash reconciliation and reducing errors. Automation can help businesses predict payment behaviors, flag potential late payments, and offer flexible payment conditions and options. Flexible payment conditions can cultivate relationships, reward loyalty, and safeguard business interests. Automated invoicing facilitates instant generation and dispatch of invoices, speeding up the collection process. By automating accounts receivable, businesses can improve their financial stability, reduce fiscal vulnerabilities, and position themselves as trustworthy and customer-centered. This not only enhances the efficiency of receivable management but also strengthens customer relationships by providing a seamless payment experience.

Measuring Accounts Receivable Performance

Measuring accounts receivable performance is crucial to identifying areas for improvement and optimizing the accounts receivable process. Effective accounts receivable management is crucial for a company's financial health, as it ensures timely payments and cash flow. Key performance indicators (KPIs) for accounts receivable management include days sales outstanding (DSO), collection effectiveness index (CEI), accounts receivable turnover ratio, and average days delinquent (ADD). The Collection Effectiveness Index (CEI) calculates the percentage of receivables a company collects during a given period, offering a clear measure of collection efficiency. The accounts receivable turnover ratio (ARTR) refers to the number of times during a given period a company collected its average accounts receivable. These metrics provide valuable insights into a company's cash flow management, financial health, and customer payment behaviors. By tracking these KPIs, businesses can refine their financial operations, reduce the risk of bad debt, and improve their overall financial performance. Monitoring these indicators helps in making informed decisions and ensuring the efficiency of the accounts receivable process.

Key Performance Indicators (KPIs) for AR Management

Measuring the effectiveness of AR management is crucial for optimizing the accounts receivable process. Key performance indicators (KPIs) to track include Days Sales Outstanding (DSO), which measures the average number of days it takes to collect payment after a sale. The Collection Effectiveness Index (CEI) calculates the percentage of receivables collected during a given period, providing insight into collection efficiency. The Accounts Receivable Turnover Ratio (ARTR) indicates how often a company collects its average accounts receivable during a specific period. Average Days Delinquent (ADD) measures the average number of days payments are overdue. Monitoring these KPIs helps businesses refine their financial operations, reduce the risk of bad debt, and improve overall financial performance.

Optimize Your AR for Better Cash Flow Management

Accounts receivable in a global environment can be challenging. A streamlined payment process is crucial for enhancing customer convenience and promptness in transactions, with clear communication and automation reducing errors and friction.

Our personalized service enables you to outsource the reminder services just after the due date of invoices.

✔ We execute the entire reminder process

✔ Customize our process to streamline your collection process

✔ Monitor the delivery and efficiency of processes

✔ Register disputes and monitor payment plans

Accounts Receivable Management Software

In today's fast-paced business environment, accounts receivable management software has become an indispensable tool for streamlining AR processes, enhancing cash flow, and minimizing bad debt. This software automates critical tasks such as invoicing, payment processing, and collections, allowing businesses to focus on more strategic activities. By leveraging technology, companies can ensure that their accounts receivable processes are efficient, accurate, and timely, ultimately contributing to better financial health and stability.

Benefits of AR Management Software

The advantages of implementing accounts receivable management software are numerous and impactful:

-

Improved Cash Flow: Automation of payment processing and collections accelerates the receipt of payments, thereby enhancing cash flow and ensuring that funds are available when needed.

-

Reduced Bad Debt: By identifying potential bad debt early, AR management software helps businesses take proactive measures to mitigate the risk of non-payment.

-

Increased Efficiency: Automating tasks such as invoicing and payment processing saves time and reduces the likelihood of human error, allowing staff to focus on more value-added activities.

-

Better Financial Planning: Real-time visibility into accounts receivable provides businesses with the data needed to make informed financial decisions and improve overall financial planning.

-

Improved Customer Relationships: Clear and timely invoices, along with multiple payment options, enhance customer satisfaction and reduce the likelihood of disputes, fostering stronger business relationships.

Cash Application and Payment Processing

Cash application and payment processing are pivotal components of the accounts receivable process. Cash application involves accurately matching incoming payments to outstanding invoices, ensuring that accounts are updated promptly. Payment processing, on the other hand, encompasses the actual handling and recording of customer payments. Together, these processes are essential for maintaining accurate financial records and ensuring that businesses receive the funds they are owed in a timely manner.

Importance of Cash Application and Payment Processing

The significance of cash application and payment processing cannot be overstated. These processes are critical for maintaining a healthy cash flow and ensuring that businesses can meet their financial obligations. By automating these processes, companies can reduce the risk of errors, improve efficiency, and ensure that payments are applied correctly and promptly. This not only enhances cash flow management but also contributes to overall financial stability.

Collect Payments and Reduce Bad Debt

Effective payment collection and bad debt reduction are fundamental aspects of accounts receivable management. By implementing robust strategies for collecting payments, businesses can minimize the risk of non-payment and improve their cash flow. This, in turn, supports the financial health of the organization and enables it to invest in growth opportunities.

Strategies for Collecting Payments

Here are some effective strategies for collecting payments:

-

Offering Flexible Payment Options: Providing customers with various payment methods can make it easier for them to pay, reducing the risk of non-payment.

-

Implementing a Clear Payment Process: A well-defined payment process helps reduce confusion and errors, making it easier for customers to understand and comply with payment terms.

-

Using Automation: Automating payment processing and collections can streamline these tasks, reduce errors, and improve overall efficiency.

-

Providing Clear and Timely Invoices: Clear and timely invoices help prevent disputes and increase the likelihood of prompt payment.

-

Following Up with Customers: Regular follow-up with customers ensures that payments are made on time and reduces the risk of non-payment.

By adopting these strategies, businesses can enhance their accounts receivable management processes, reduce bad debt, and maintain a healthy cash flow.

Difference between Accounts Payable and Accounts Receivable

Accounts payable and accounts receivable are two fundamental concepts in accounting that are often confused with each other. Accounts payable refers to the amount of money a company owes to its suppliers or vendors for goods or services purchased on credit. This represents a liability on the company’s balance sheet. On the other hand, accounts receivable represents money owed to a business by its customers for goods or services provided, making it an asset. In essence, while accounts payable is about the money a company needs to pay out, accounts receivable is about the money a company expects to receive. Understanding the distinction between these two is crucial for effective financial management and planning.

Cost Savings in Accounts Receivable Management

Effective accounts receivable management can result in significant cost savings for businesses. By automating accounts receivable processes, companies can reduce manual labor and errors, leading to lower administrative overhead costs. Automation streamlines the payment process, making it more efficient and less prone to mistakes. Additionally, efficient accounts receivable management can reduce the costs associated with debt collection, bad debts, and late payments. By offering flexible payment options and ensuring timely follow-ups, businesses can minimize the risk of overdue payments and improve cash flow management. These cost savings not only enhance the company’s financial health but also free up resources that can be invested in growth opportunities.

Benefits of Efficient AR Management

Efficient accounts receivable management offers numerous benefits that can significantly impact a business’s financial health. Improved cash flow and liquidity ensure that funds are available to meet short-term obligations and invest in growth opportunities. Reducing the risk of bad debt enhances financial stability and reduces the costs associated with debt collection. Efficient AR management also improves customer relationships and satisfaction by ensuring clear and timely communication. Increased productivity and efficiency result from automating AR processes, allowing staff to focus on more value-added activities. Better financial planning and forecasting are possible with real-time visibility into accounts receivable. Overall, efficient AR management contributes to a company’s long-term success by maintaining a healthy cash flow and supporting strategic financial planning.

Importance of Managing a Company’s Accounts Receivable

Managing a company’s accounts receivable is crucial for maintaining a healthy cash flow and ensuring the financial stability of the business. Accounts receivable represents a significant portion of a company’s assets, and effective management of these assets is essential for financial planning and decision-making. By monitoring and controlling accounts receivable, businesses can identify inefficiencies in their billing and collection processes, reduce the risk of bad debts, and improve customer relationships. Furthermore, accounts receivable management can provide valuable insights into sales trends, customer buying habits, and market conditions. These insights enable businesses to make informed financial decisions, drive growth, and maintain a healthy cash flow, ultimately contributing to the company’s long-term success.

You have a clear overview of all our activities 24/7

Monitor your Accounts Receivable management process and generate the AR reports you need anytime.

You’re in full control

We create an Accounts Receivable strategy based on the number of invoices and where your customers are located. Our technology and intelligence optimise your cash flow by balancing between AR risk and customer...

Complete customer support

Your customers need statements of account? Copies of invoices? Payment negotiations? Payment plans? We support them so you can focus on your core business activities.

We operate in your name

Our in-house, locally-based accounts receivable management experts act as your local team to support and remind your customers to pay at the right time, with the right message. We use emails, letters, phone calls,...

Get in touch

Get tailored advice from a local representative

Free consultation